Real Estate Loans

Add to your company’s real estate portfolio with ease by utilizing our vast real estate financing capacity. We’ll connect you with the financial tools to buy, renovate, or refinance real estate assets.

Access the properties you need to take your business to the next level.

Call Us Today!

1 (408) 451-3993

04. Contact

Advance Your Business With Commercial Real Estate

Real Estate Loans are much more versatile than they might seem at first glance. With short and long–term options for owner/operators, retailers and investment property managers, there is a path to real estate ownership for your business.

- Finance the purchase of new or existing properties

- Repair and renovate buildings that need improvement

- Expand your workspace or upgrade amenities

With flexible terms and conditions, we can find a real estate loan that suits the size of your ideal property.

Financing Options

Construction Financing

Sometimes building from the ground up costs less than acquiring or modifying an existing property. When you need customization and have a background in equity, this option may be right for you.

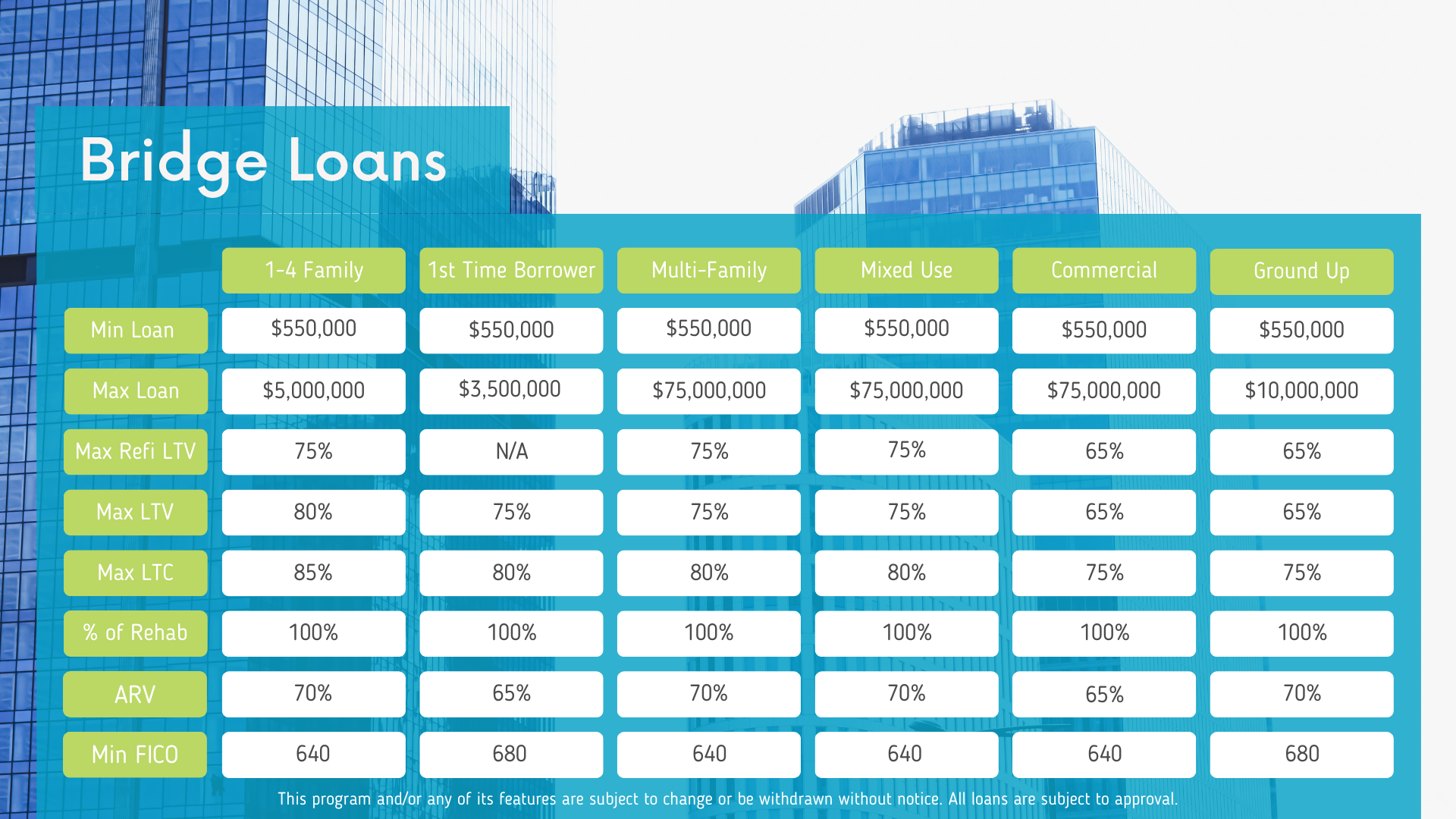

Bridge Loan

Get a jump on your competition. When you need access to a new property now, we can get you funds to act fast while working to secure long-term financing.

SBA Loan

When your target property is out of reach in terms of available credit, but your business promises high cash flow, mezzanine investors are a great way to fill the gap.

Advantages of Real Estate Loans

- Buy new property with confidence.

- Rebuild damaged credit.

- Use real estate as security.

- Break upfront costs into manageable payments.

Frequently Asked Questions

When are Real Estate Loans not a good fit?

Which Real Estate Loan is right for my business?

Not all real estate loans are the same. This is an advantage to businesses that don’t fit a common mold. The right loan for you will depend on the size of your business, your overall financial picture, and your business goals. Our expert brokers will help you narrow down the options until you find a loan that’s just right.

How do I secure a loan without real estate assets?

If your business has excellent credit, you may qualify for unsecured loans that don’t require collateral. You can also use other assets like equipment and stocks as security.

What if I want to upgrade real estate using sustainability features?

Adding solar panels, a greywater system, or upcycled building materials is not only great for the environment but also financially wise. The SBA allows businesses making these types of improvements to borrow higher than the average $5M cap at $5.5M. There are also tax advantages for businesses that build sustainably.

Additional

Questions?

For more information, contact one of our friendly and knowledgeable financing experts today. Give us a call at:

Pre Apply

Start your journey to business funding.